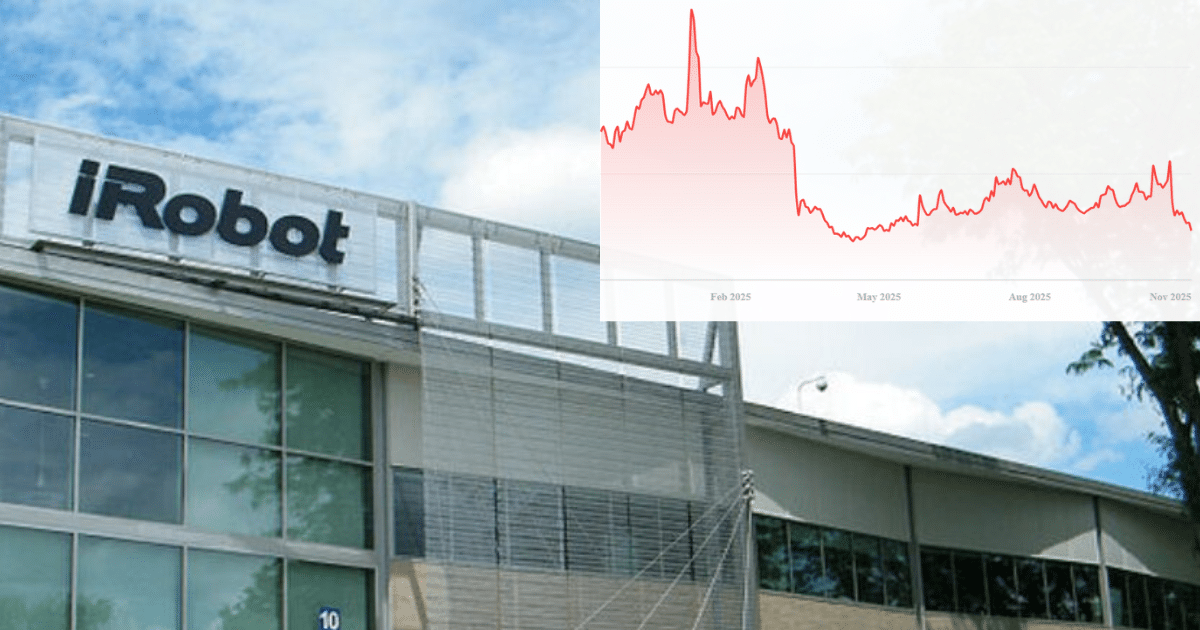

iRobot Corp., the company best known for its Roomba robot vacuums, released its financial report for the third quarter of 2025. The company saw steep declines in both revenue and profit compared to the same period last year. iRobot cited tough market conditions, manufacturing delays, and shipping disruptions that slowed sales and raised costs.

This news comes on the heels of iRobot’s September 2025 SEC filing, as summarized by Investing.com, where iRobot warned that if it could not regain compliance with its loan covenants, it could be forced to “significantly curtail or cease operations” and “may seek bankruptcy protection.”

iRobot Q3 2025 Earnings Overview

For the quarter ending September 27, 2025, iRobot reported $145.8 million in revenue. This was down from $193.4 million in the third quarter of 2024 — about a 25% drop.

The company’s gross margin (the percentage of revenue left after covering production costs) slipped slightly to 31.0% from 32.2% a year earlier. On a non-GAAP basis, which excludes certain one-time expenses, the margin was 31.2%, down from 32.4%.

iRobot Revenue and Profitability Decline in Q3 2025

GAAP and Non-GAAP Operating Losses Compared Year-Over-Year

iRobot’s results moved from profit to loss this quarter. Under GAAP accounting (the official U.S. financial standard), the company posted an operating loss of $17.7 million, compared with a $7.3 million profit in the same quarter last year.

When adjusted for special or one-time costs (the non-GAAP version), iRobot still showed a $9.9 million loss, versus a $15.1 million profit in 2024. These losses were in spite of efforts to restructure operations, which we reported on earlier this year.

Regional Sales and Product Mix in iRobot’s Third Quarter 2025

U.S., EMEA, and Japan Market Performance

Sales were down across all of iRobot’s major regions:

| Region | Reported Change (Year-over-Year) | Change Adjusted for Currency |

|---|---|---|

| United States | –33% | N/A |

| Europe, Middle East, and Africa (EMEA) | –13% | –14% |

| Japan | –9% | Flat |

The steepest drop came from the U.S., where soft consumer demand and ongoing shipping issues continued to weigh on results.

iRobot Cash Position, Inventory, and Liquidity Update

Cash and Restricted Funds at the End of Q3 2025

By the end of the quarter, iRobot’s available cash had fallen to $24.8 million, down from $40.6 million in June.

The company also had $5 million in restricted cash, which it fully used on September 30. In its filing, iRobot said it has no additional sources of funding currently available.

CEO Gary Cohen on iRobot’s Q3 2025 Performance

Company Statement on Market Headwinds and Supply Chain Delays

In a statement, CEO Gary Cohen acknowledged the company’s difficulties:

“Our third-quarter revenue fell well below our internal expectations due to continuing market headwinds, ongoing production delays, and unforeseen shipping disruptions. This shortfall increased cash usage and pressured profitability, as we were unable to fully leverage our fixed cost base.”

Strategic Review Process Cited in Q3 Filing

Cohen added that iRobot is continuing its strategic review process, previously announced in March of this year, which was detailed in the company’s Form 10-Q filed with the SEC on November 6, 2025. The review will explore high-level options to strengthen the company’s finances.

Summary of iRobot’s Third-Quarter 2025 Financial Results

iRobot’s Q3 2025 report is grim: sales are down, losses are growing, and cash reserves are thinning. While iRobot continues to sell a large share of higher-end robot vacuums, challenges in supply chains and consumer demand have made profitability harder to maintain.

Top Robot Vacuums

iRobot Roomba Robot Vacuum Buyers Guide 2025

iRobot has rolled out a revamped Roomba lineup for 2025, introducing key changes to its long-running series. From the entry-level 105 series to the top-of-the-line 705 series, these new models showcase a range of noteworthy updates that could signal a pivotal shift for the company. This guide delves into their major enhancements and offers insights into how they’ll perform in everyday life. See the Guide